Live Forex Trading Maximizing Your Profits in Real Time

Live Forex Trading: Maximizing Your Profits in Real Time

Forex trading, or foreign exchange trading, has emerged as one of the most lucrative financial markets globally. With a daily trading volume exceeding $6 trillion, the Forex market operates 24 hours a day, providing ample opportunities for traders to capitalize on price movements. Understanding the dynamics of live Forex trading can not only enhance your trading skills but also significantly impact your profitability. Platforms like forex trading live Pro Trading UAE play a crucial role in this process, offering tools and resources that are essential for success.

Understanding Live Forex Trading

Live Forex trading refers to executing trades in real-time based on current market conditions. Unlike other financial markets that have limited hours of operation, the Forex market is open from Sunday evening to Friday evening. This continuous trading environment allows traders to respond to market news, economic data releases, and geopolitical events as they happen.

The Importance of Live Trading

When engaging in live Forex trading, several factors come into play:

- Volatility: The Forex market is known for its volatility, which can create opportunities for significant gains or losses within short time frames.

- Liquidity: High liquidity ensures that trades can be executed quickly without significant price slippage, allowing traders to enter and exit positions with ease.

- Market Sentiment: Understanding live market sentiment through real-time data can help traders make informed decisions based on current trends.

Tools and Technologies for Live Forex Trading

To navigate the complexities of live Forex trading, traders rely on various tools and platforms. Here are some essential components:

Trading Platforms

Most Forex traders use trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), or proprietary platforms provided by brokers like Pro Trading UAE. These platforms offer real-time quotes, charting tools, and automated trading capabilities to enhance the trading experience.

Technical Analysis Tools

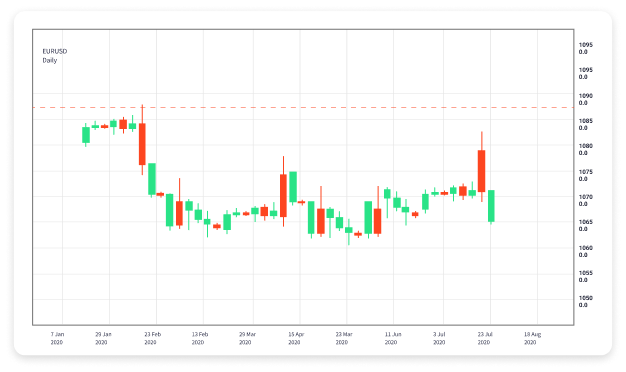

Technical analysis is a key aspect of Forex trading. Utilizing indicators such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands can help identify potential entry and exit points during live trading sessions. Chart patterns and trend lines also play a significant role in predicting future price movements.

Forex News Feeds

Staying informed about economic news and events is crucial for successful Forex trading. Economic calendars and news feeds provide real-time updates on data releases, central bank announcements, and geopolitical developments that can impact currency prices.

Strategies for Live Forex Trading

Developing a robust trading strategy is essential for long-term success in live Forex trading. Below are several popular strategies that traders often employ:

Scalping

Scalping involves making numerous trades throughout the trading day to profit from small price movements. This strategy requires a high level of concentration and quick decision-making skills, as trades are typically held for only a few minutes.

Day Trading

Day traders open and close positions within the same trading day, aiming to capitalize on intraday trends. This strategy requires a good understanding of market dynamics and the ability to react quickly to price changes.

Swing Trading

Swing trading focuses on capturing larger price moves over several days or weeks. Traders use technical and fundamental analysis to identify potential reversal points and trends, allowing for bigger profit potential than day trading or scalping.

Position Trading

Position trading involves holding positions for weeks, months, or even years based on long-term trends and fundamental analysis. This strategy requires less time commitment compared to day trading and is suitable for those who prefer a more hands-off approach.

Risk Management in Live Forex Trading

Risk management is one of the most critical aspects of Forex trading. Implementing effective risk management strategies can protect your capital and ensure your longevity in the market. Here are some key practices:

- Setting Stop-Loss Orders: Always use stop-loss orders to limit potential losses on trades. This ensures that you exit a position if the market moves against you.

- Proper Position Sizing: Calculate the appropriate position size based on your account balance and risk tolerance. Never risk more than a small percentage of your capital on a single trade.

- Diversification: Avoid putting all your capital into one trade or currency pair. Diversifying your portfolio can help manage risk effectively.

Conclusion

Live Forex trading offers immense opportunities for both novice and experienced traders. By understanding the market dynamics, utilizing the right tools and technologies, and adopting effective strategies and risk management practices, you can significantly enhance your trading performance. Platforms like Pro Trading UAE provide the necessary support and resources to navigate the complexities of the Forex market, helping you achieve your trading goals.

As you delve deeper into the world of live Forex trading, remember that success requires continuous learning, patience, and discipline. Stay informed, keep practicing, and always adapt your strategies to changing market conditions to maximize your profits in real time.